Driverless cars: revolution on the streets?

The vehicle of the future, a genuine road robot, will revolutionise the transport of people and goods, traffic safety and the urban landscape. It will decongest cities and reduce pollution, as long as it is electric and, above all, collective.

An investigation by Barbara Vignaux - Published on , updated on

Several car manufacturers are banking on the sudden emergence in the next few years of a major technological innovation set to change radically how people and goods get around. Heralded by the driver-support systems that appeared 30 years ago, the driverless car revolution is actually already here. But it will no doubt be a much more gradual process than the manufacturers would sometimes have us believe in their triumphant press releases. There’s a long way to go from the vehicles currently out there to the 100% electric connected robot car of the future. Eventually however, the second transport revolution (the first was when we traded in the horse for the combustion engine) will completely transform society, in a variety of ways: road safety, the urban environment, air pollution and our very relationship with mobility and transport. We take a look at the projects currently under way and the arguments put forward by the pros and antis.

Pioneered in the US

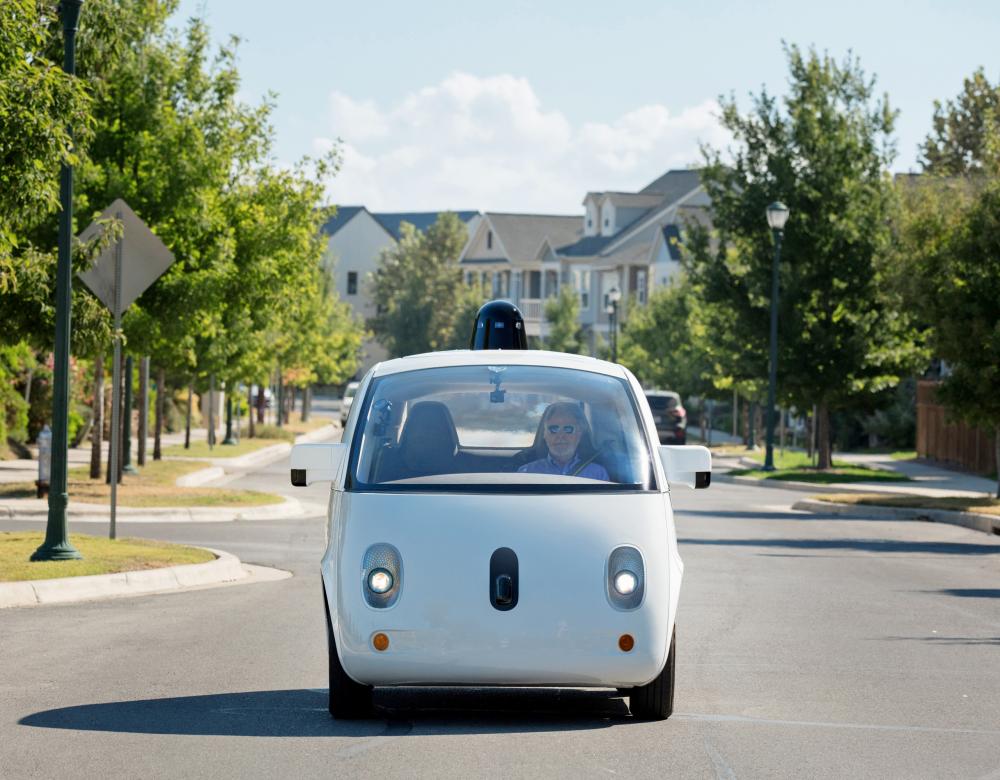

It is in the US that most progress along the road to the driverless car has been made to date: more than eight million kilometres in the case of the pioneering Waymo, Google's driverless car subsidiary. Waymo's boldest initiatives have included the option for Uber customers to hop in a driverless vehicle in Pittsburgh, Pennsylvania (the service was suspended following the fatal accident in Tempe, Arizona in March 2018). Pennsylvania is a favourite testing ground for experimenters because here it is not illegal to drive without holding on to the steering wheel (a driver must be present behind the wheel, though). But numerous trials have also taken place in the Netherland, Germany, Japan, the United Kingdom and Singapore.

From automobile to robot car

From horse-drawn to engine-powered to self-driving: the driverless car will be at the heart of the second great transport revolution.

Say goodbye to shiny bodywork and roaring engines – this is the era of the connected robot car! ‘We took the leap from horse-drawn to engine-powered transport. Now, with the driverless car, we are entering the era of brain-powered transport – in this case the computer-controlled vehicle. It’s the second great transport revolution,’ says Fawzi Nashashibi, a research scientist at INRIA, the French Institute for Research in Computer Science and Automation. INRIA’s definition of the driverless car is a vehicle capable of driving on all kinds of roads without driver intervention. This technology is nascent in the advanced driver assistance systems (ADAS) now featured in most new vehicles: power steering, ABS, automatic transmission, integrated GPS, reversing camera, etc. Other developments are more recent, such as automatic parking, available on top-of-the-range models, or the anti-collision system. The driverless car also comes in the form of the shuttle vehicles already in operation in France and other countries. Eventually, it will be connected. This is the famous ’level 5’ on the car automation scale, a car that won’t need a steering wheel or pedals because it will simply drive itself. This will be made possible by more sophisticated developments in artificial intelligence, which has its strengths and weaknesses. How do we give a machine the common sense possessed by humans, for example? When the car in front stops, a human being will easily interpret the situation: an accident, a red light up ahead, a van unloading goods… They will change their behaviour accordingly, choosing either to wait or to drive on. But what about a robot? This is just one of the questions raised by the advent of the “mobile brain”.

The driverless communal taxi

’ Cars will only represent real progress if there are fewer of them than there are of our current conventional vehicles,’ says Sylvie Landrieve, co-director of the Vies Mobiles Forum. That means they will have to be communal, the first stage of a virtuous circle that reduces traffic, air pollution and the automobile’s stranglehold on the city. In this respect, the recent growth of carpooling – practised by more than 60% of French road users – and car sharing are encouraging signs. The Autonom Cab project being developed by the Lyon SME Navya is part of this process. Controlled by an online application, it can carry up to six passengers and is due to be trialled in Lyon and Paris in 2018.

Goodbye driver? Not yet!

Media hype makes it easy to overlook the fact that it will be years before the road conditions for 100% driverless cars are in place.

With the exception of experimental schemes, no country in the world has so far authorised driverless vehicles. Before that can happen, we have to define the hazards involved – road safety and cyberhacking for example – and how they would function in terms of traffic law, changes to the urban infrastructure, motor insurance policies, etc. Road safety is one of the main arguments put forward by advocates of the driverless car (1), since 90% of road accidents (nearly 60,000 of them in France in 2017, causing 3,700 deaths) are down to human error. However, today’s semi-autonomous cars are not 100% safe, as illustrated by the first fatal accident and other mishaps involving them. A software defect was apparently responsible for the death of a cyclist hit by a driverless can in Tempe, Arizona in March 2018. But driver overconfidence is sometimes at fault, resulting in the driver’s inability to take control if necessary, as was the case of the accident involving a Tesla in California in May 2018, fortunately not a serious one. These accidents – less socially acceptable than accidents caused by people – also remind us that identifying the legally responsible party is not a simple matter. Who is at fault? Driver, manufacturer or software designer? And as for certification, should it be applied to each of the on-board devices (such as radar and lidar), the navigation software or the vehicle itself? For what distance and under what conditions should a test car be operated before it can be certified? Google is making much of the accumulated distance covered by its cars, but some of them have been issued with traffic violations … for going too slowly.

(1) The ‘Safer Roads with Automated Vehicles?’ report (published by the OECD’s International Transport Forum in May 2018) calls for a very cautious approach in this respect.

What will they be used for, and by when?

The advent of the ‘100% driverless’ car may come about through the gradual evolution of the world’s existing vehicle stock and through advanced driver assistance systems (ADAS). As a result, very selectively autonomous private cars (level 2) could be in car showrooms by 2020. However, the 100% driverless connected car is unlikely to be on our roads until 2050 or 2060, or perhaps even later than that (1). In the meantime, we will see more widespread adoption of three uses of the autonomous vehicle that are already being trialled. In the case of private vehicles, the automatic driving function will initially be restricted to multiple-carriageway roads such as motorways, because on these roads the driving speed is more stable and the number of obstacles limited. Shuttle vehicles will initially be used for journeys not served by other modes of transport in enclosed sites such as airports, industrial complexes or sites and in residential areas poorly served by existing transport. Later, they may take over from current bus services – and could result in lower fares since driver salaries account for half of bus operators’ costs, although this may of course contribute to unemployment. These little shuttles will be modular, with sections hooking up and disconnecting in line with the timetable and user requirements. Lastly, high-tech driverless robot taxis, possibly for communal use, will be booked through an online app and are likely to be popular with the five to six million minicab users in France alone, who will switch to using this Uber-style service. By then, connected infrastructures such as smart carriageways, traffic lights and signs should be in place.

(1) White paper on the connected driverless car, INRIA, May 2018

Not just cars

Ambulances, refuse collection trucks, delivery vans, farm tractors, shuttles on private sites, postal vans, industrial vehicles and flying taxis: the autonomous or semi-autonomous vehicle already exists in dozens of variations, in real life and in projects. For them to become an everyday reality, each of these possible uses must hit upon a viable economic model – and recruit professionals that have not yet been trained. This photo is of Volvo’s driverless truck in the Kristineberg Mine in northern Sweden, 1300 metres underground.

France : leading the way in shuttle development

France's National Autonomous Vehicle Strategy, designed to encourage many more experimental development schemes, was announced in May 2018.

'Highly automated' vehicles on French roads within two years: this is the government's ambitious target, with level 3 cars on the road by 2020 and level 4 vehicles out by 2022 (see infographic). Between the end of 2014 and April 2018, 26 private car experimental development programmes were authorised, with more than 200,000 kilometres driven without a single accident involving equipment damage or bodily injury (1). In addition, some fifteen experimental programmes developing communal shuttle vehicles (2) have been carried out nationwide. With two leading manufacturers, Nayva and EasyMile, France is in a good position. The various projects include an on-demand mobility service for the general public, trialled in an initial ten-kilometre experiment at Rouen technology park. The government is also planning to make changes to the French highway code and the rules of responsibility, along with upgrading the road infrastructure to make it interactive and increasing by 50% the number of apprenticeships in the automotive industry by 2022. "France has everything going for it to be at the cutting edge of this technological transformation," says Marc Charlet, director of the Mov'eo competitive cluster. "We have motor manufacturers, equipment manufacturers, universities, research laboratories, SMEs and start-ups, plus local authorities ready and willing to trial new mobility solutions. Few other countries have such a complete ecosystem." But there is a one important consideration: all the major industrial countries are involved in the race, which is led in some respects by the Internet giants... none of which is French.

(1) Développement des véhicules autonomes, orientations stratégiques pour l’action publique [Development of autonomous vehicles, strategic approaches for public action]. Review document, May 2018

(2) The shuttles currently on the road travel at a maximum speed of 12 kilometres per hour.

Greener transport

Transport accounts for a quarter of the world’s greenhouse gas emissions, hence the supposed advantage of the driverless car, which runs on electricity rather than oil. In France, the government’s objective is to increase sales of 100% electric vehicles fivefold by 2022, reaching 150,000 units. But this ‘green’ reputation should be taken with a pinch of salt, given that the manufacturing processes currently used to make these cars are very energy-hungry and require large amounts of lithium for the batteries. But new technological advances – hydrogen batteries? – could make electric vehicles greener in the future.

Urban dream or oppidan nightmare?

Imagined idyll or downright rejection – the driverless car elicits two contradictory reactions, revealing the hopes and fears it evokes.

The optimists’ view: a carefree, happy world with safe, tranquil, eco-friendly cities devoid of vast car parks and time-wasting traffic jams. The pessimists’ view: a nightmarish world of tentacular towns populated by empty or nearly empty vehicles following absurd trajectories, with raging unemployment and drivers monitored by an omniscient Big Brother… To put it mildly, the driverless car evokes the most extreme hopes and fears. And justifiably so: the arguments in favour can just as easily be used against it. Take improved urban land use for example. With a private vehicle spending on average 95% of its life parked and with road infrastructures taking up half of the urban space, the communal driverless car, continually on the road, would free up a huge amount of space that could be given over to parks or housing. Except if motorists decide, in addition to their usual car, to buy a driverless car to take the kids to school or Wednesday football practice, thereby taking up an extra parking space! Another example is the journey time, which people could instead use to work or rest. On the one hand, it could lead to a better work-life balance. On the other, this extra free time would make it easier to justify longer journey times, therefore leading to residential areas right on the edge of cities, miles from the city centre. Which would mean building more roads and lead to more urban sprawl. The fact that the views on this subject are so strongly opposed is nothing new: it’s been the same with every revolution.

Public data … and private data

The 100% autonomous vehicle will be ultra-connected to other vehicles, road infrastructures and the Cloud (where data and software will be stored and accessible online). This will make it easy to update the necessary data (maps, weather and traffic info) and programs (driving software). But this entails two risks, the first of which is cyberhacking. In the US, IT security research scientists have managed to take control of several semi-autonomous vehicles. The second is the protection of private data, such as passenger names and identities, the dates and times they are picked up, the route taken, and more. All of this information could be recorded – and exploited – by online robot taxi applications or software suppliers such as Google.

Motor manufacturers or Web giants?

Motor manufacturers face stiff competition from the Web giants, which have acquired considerable expertise in data collection and management.

Waymo (Google), Apollo (Baidu), Mobileye (Intel), Apple and Microsoft: all the Web giants are investing in driverless car technology. It’s unlikely they will ever start manufacturing vehicles, but they might sell their connection and digital data services to companies that are. Indeed, eventually, according to INRIA*, 70% of the added value in the motor industry could come down to on-board software. Of course, the conventional automotive industry players are very interested in this technology, first among them being the likes of General Motors, Daimler, Ford, Honda, and Nissan/Renault. Some have created alliances, like the companies in the 5GAA network, made up of German manufacturers and telecoms operators who are looking at how road infrastructures could connect with vehicles through the future 5G network which is due to follow 4G. Indeed, in 2015 a German consortium (Audi, BMW and Daimler) bought Nokia’s Here mapping system (so that it would not have to rely on Google) for the princely sum of 2.8 billion euros. Around these old and new names in the industry, myriad specialised start-ups are appearing, developing shuttle vehicles in the case of Navya, driving software in the case of nuTomony, and more… Lastly, transport operators like Keolis and RATP in France, along with local authorities, are actively involved in experimental programmes. As in La Rochelle for example, where the first trials of autonomous shuttle vehicles were conducted by INRIA as early as 2011. No one wants to be sidelined by the development of a sector as strategic and the motor industry, with around 100 million units sold worldwide each year (with two million sold in France).

* The French National Institute for Research in Computer Science and Control